Housing Market

The housing correction intensifies—Blackstone to stop buying homes in these 38 regional housing markets

Lance Lambert

Fri, August 26, 2022 at 5:06 AM

The Pandemic Housing Boom brought a flood of investors into the U.S. housing market. Mom-and-pop landlords rushed in. Airbnb hosts added to their portfolios. Amateur home flippers returned with a vengeance. Record home price appreciation also brought out the big dogs: Wall Street.

But that party is over now. Or at least on pause.

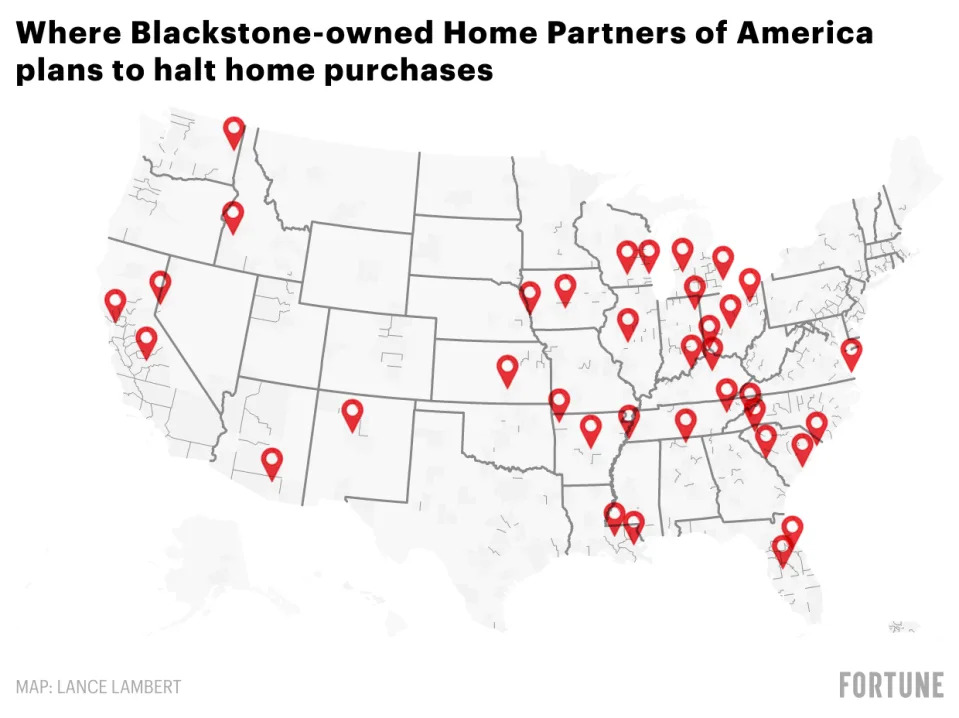

Look no further than Blackstone-owned Home Partners of America. The firm, which is one of the nation’s largest private landlords, announced on Thursday it will halt single-family home purchases in 38 U.S. regional housing markets by the end of September.

“We assessed several factors such as home price appreciation, state and local regulations, and market demand to guide our investment plans to best serve consumers. We hope to resume purchasing homes in these markets in the future,” wrote Home Partners of America in a press release.

The pullback by Home Partners of America, which was purchased by Blackstone for $6 billion in 2021, comes as average joes and investors alike put their homebuying plans on hold. The result isn’t pretty: On a year-over-year basis, existing home sales and new home sales are down 20.2% and 29.6%, respectively.

The announcement by Blackstone-owned Home Partners of America also comes just as more Wall Street firms are realizing that the intensifying housing correction could translate into falling home prices. Last week, Fitch Ratings released a report finding that U.S. house prices are at risk of falling up to 15%. This week, Moody’s Analytics downgraded its outlook for U.S. house prices—projecting that a 5% to 10% price cut could manifest.

That raises the question: Are deep-pocketed Wall Street firms simply pausing their buying plans because they think better discounts (i.e., falling prices) await? After all, firms like Blackstone have made it clear that long term they want to own more—not fewer—single-family homes.

If a recession hits, Moody’s Analytics thinks significantly “overvalued” markets like Boise, Reno, and Spokane could see home prices fall between 15% to 20%. Those at-risk markets are also among the places where Home Partners of America plans to halt purchases. Some other “paused” markets—including Deltona, Fla., and Columbus—are also at risk. Some others aren’t. In fact, Moody’s Analytics thinks home prices will go higher in Cincinnati.

View this interactive chart on Fortune.com

Back in 2019, Blackstone backed away from the single-family home business after selling its remaining shares of Invitation Homes. Then in 2021, it made a big splash with its purchase of Home Partners of America. At the time, Home Partners of America owned 17,000 single-family homes.

While Home Partners of America plans to back off in 38 markets, it doesn’t plan to completely stop buying. In total, it operates in 76 regional housing markets. This pause affects only one in two of those regional markets. But if you look at Home Partners’ buying activity, these paused markets represent an even smaller share. At least that’s according to Blackstone.

“We and Home Partners remain fully committed to expanding access to homeownership and continue to actively purchase homes on behalf of our residents in more than 20 of the highest growth markets in the U.S. We are pausing in markets that represent less than 5% of our recent activity,” a spokesperson for Blackstone tells Fortune.

Comments

I used to live in Washington state just north of Spokane and one thing I certainly noticed which was a primary reason why I moved was that the county did its part to jack up home values. I just got a call from my old neighbor, and he was mad as hell because Spokane county jacked up his assessed value by over $98,000.00. IN ONE YEAR!!! I checked my old property, and it went up over $107,000 in value in a single year. That is simply insane, especially since my home was a manufactured home. This is in an area 20 miles north of Spokane. The property taxes are starting to look insane as a result. I was spending near $300 a month for the privilege of owning property in that state. The contractor I used on occasion was spending almost $500 a month in property taxes. He had a nice house, but it wasn't that nice.

When this market implodes, and it will, things are going to get really ugly. They got away with this back in 2008, I don't think they can get away with it this time.

A friend of ours husband passed away in 2015. In 2017 she sold her home and moved to Olympia Washington She bought a yet to be finished house in a "development". She soon found out she was surrounded by libtards. Six weeks ago she bought a place "back home". A mile down the road. She listed her home in Olympia for $615,000. The next day she had a looker, and an offer. The offer was $20K above asking. In three days she sold her house for $20K above asking.She is VERY glad to be "home", and we are very glad to have her back.

Corrupt local government jacking up property taxes is nothing new. People need to organize and protest such increases. Vote the major, city council, and the assessor out. I have seen it work.

On the other side, if the people are voting for every tax or millage increase, they deserve what they get.

Proud to vote against EVERY and any tax increase no matter what the cause. They always want more later and what you vote for rarely gets done and money misspent. The middle class is overtaxed as it. Get ready to pay more from the 3% corp tax increase Biden and the DEMOCRATs passed last week.

I agree that its nothing new, it's the level that's concerning.

With such a high increase in only one year it would not be too hard to find and get every neighbor in your area to storm the township office all at once! Don't forget to bring your torches and pitchforks (but leave them all outside the door) Making the scene look like an old Frankenstein movie.

Also invite the press and see those increased taxes go down in smoke! (I almost said UP in smoke 😲)

I know of nobody in the 24 years that I lived there who appealed an increase and won relief. I very much doubt too many have ever been granted.

Spokane County collects taxes based upon the budget, not property values. When I lived there, we had a $ 100,000.00+ increase in property value one year and our property taxes actually went down as our place did not increase in value proportionally as did the county average.

The same has happened a couple of times in the state and county in which I currently reside. Property value creates the basis. The tax rate establishes the taxes. In time of significant property value increase, one often offsets the other.

Brad Steele

Sad to say I was never that lucky, all I ever saw were double digit (percentages) increases in my taxes.

Property value doubled for some folks around here. Mine went up about 10%.

County sets tax rate after budgets are approved. My property taxes dropped 20 %.

FOR NOW.

My bro's daughter who's in Tehas is trying to dump her joint and move to Reno. Her husband's in Reno and working some DOT jobbie he had in Tehas that he lateraled over to Nevada? I told her she should've had dumped and ran earlier in the year. Now with the feds jacking up the rates she's stuck and toying with the idea about "renting". She better pray biden don't shut the country down again. Free renters. Also I think the inflation will hit 15% by the end of the year (another rate hike is a coming). So that joint ain't moving.